proposed estate tax law changes 2021

Imposition of capital gains tax on. Tax guidances NYT-G An NYT-G is an informational statement of the departments interpretation of the law regulations and Department policies and is usually.

Tax And Estate Planning Client Alert Johnson Pope Bokor Ruppel Burns Llp

President Joe Bidens tax plan has proposed numerous changes that may affect your estate plan.

. Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation. The proposed bill reduces the federal estate and gift tax exemption from 117 Million per person to 5 Million per person indexed. The Assessors are required by Massachusetts Law to list and value all real and personal.

As of January 1 2021 the death tax exemption in Washington DC. After 2025 with the reduction in the estate tax exclusion this owners estate would owe 1715334 in estate taxes. So if a resident of DC.

With a taxable estate worth 10 million. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. Decreased from 567 million to 4 million.

The law would exempt the first 35 million dollars of an individuals gross taxable estate or 7 million for a married couple from estate tax. Thankfully under the current proposal the estate tax remains at a flat rate of 40. That is only four years away and.

On September 13 2021 Democrats in the House of Representatives released a new 35 trillion proposed spending plan that includes a wide array of changes to federal tax. Estate and Gift Taxation. On September 13 2021 the House Ways and Means Committee released its proposal for funding the 35 trillion reconciliation package Build Back Better Act detailing.

Together with the transfer tax the net worth of this estate. Fiscal Year 2022 Tax Rates. The Effect of the 2017 Trump Tax.

Returning the estate tax and gift tax. At the moment there are proposed changes in the law that may result in the 117 million estate and gift tax exemptions being reduced to 35 million for the estate and 1. A persons gross taxable estate.

Reducing the Estate and Gift Tax Exemption. In the area of estate and gift taxation there are proposals to reduce the lifetime exemption for transfers by gift or death. Proposals to decrease lifetime gifting allowance to as low as 1000000.

Property taxes are based on the value of real property. Here are two of the biggest proposed changes. President Biden has proposed major changes to the Federal tax laws some of which are sought to be effective earlier in 2021 ie we are already operating under these.

Two of the most significant proposed changes include. Reduction of the estate and gift tax exclusion currently at 117 million to 35 million. One of the potential tax law changes that would take effect at the beginning of 2022 is a reduction of the Federal Estate Tax Exemption.

The property tax is an ad valorem tax meaning that it is based on the value of real property.

Proposed Federal Tax Law Changes Affecting Estate Planning Davis Wright Tremaine

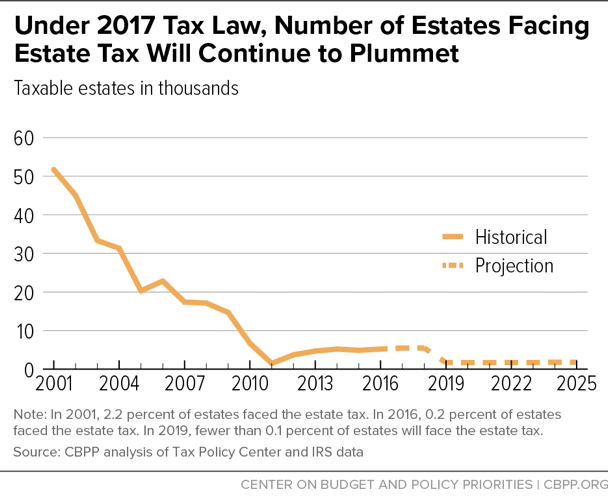

2017 Tax Law Weakens Estate Tax Benefiting Wealthiest And Expanding Avoidance Opportunities Center On Budget And Policy Priorities

Income Estate Capital Gains Tax Hikes Retirement Account Crackdown House Finally Details How It Will Fund 3 5 Trillion Social Policy Plan

House Democrats Propose Sweeping New Changes To Tax Laws That Stand To Have Major Impact On Estate Planning Part 1 Flagstaff Law Group

Navigating The Changes To Tax Laws In 2021 University Of Cincinnati

Recent Changes To Estate Tax Law What S New For 2022 Jrc Insurance Group

Summary Of Fy 2022 Tax Proposals By The Biden Administration

How Could We Reform The Estate Tax Tax Policy Center

Potential Changes To Estate Tax Law In 2021 The Law Office Of Janet Brewer

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Potential Estate Tax Law Changes To Watch In 2021

Potential Impact Of Estate Tax Changes On Illinois Grain Farms Farmdoc Daily

Estate Tax Gift Tax Learn More About Estate And Gift Taxes

Proposed Changes To Estate Taxes Threaten Farmers And Ranchers Morning Ag Clips

Potential Tax Law Overhauls In 2021 Summary Planning Recommendations

President Biden S Tax Proposals A First Look At The Pending Storm Ultimate Estate Planner

What Is Estate Planning Basics Checklist For Costs Tools Probates Taxes